Dedicated Orange County EDD Audit Attorney Ready To Assist You

EDD audits are focused on reclassifying independent contractors to employees. This audit will include a review of business records for the past three years, specifically records with special interest on documentation about your employees and independent contractors. An EDD audit may leave an impact that financially impacts the business growth and business model. After a worker is reclassified to an employee, the business will be assessed taxes, penalties, and interest. Additionally, the EDD can collect from the responsible party. The business does not need to be shut down for the EDD to assess and collect personally from the owner, officer, employee, etc.

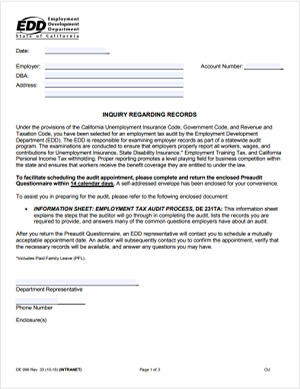

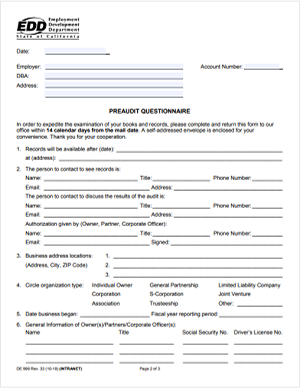

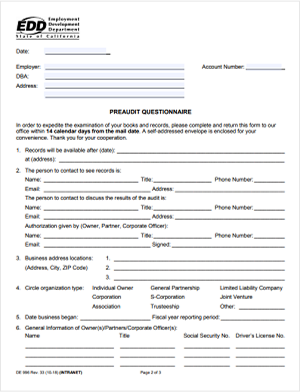

If you receive an Inquiry Regarding Records notice from the EDD, your business has been selected for an audit. Unlike the IRS notice of audit, the EDD audit notice can be inconspicuous and some business owners do not even know they are under audit. In addition, the EDD will send your business a Preaudit Questionnaire. The EDD requires the Pre-audit Questionnaire to be completed prior to scheduling the initial audit meeting.

Once the auditor is assigned, they will request an in-person meeting. The benefit of hiring a lawyer is that you do not need to be present at the initial interview. Your attorney can gather all of the documentation from the business and can handle the interview and audit without you attending the meeting. After the audit, the results are discussed through a phone call or in person. In the interview, disputes are resolved and more information that was not part of the initial audit is identified and reviewed if necessary. You also have the option of requesting a pre-assessment conference with the auditor’s supervisor if you’re not satisfied with the auditor’s terms of the agreement.

The audit generally has three results:

- No indication of differences, which points to a no-change audit.

- A payment that is higher than the stipulated amount, which results in a refund.

- An underpayment, with an assessment of the differences, carried out.

Trusted Orange County EDD Audit Lawyer

An EDD audit can be very stressful and can lead to a lot of complications for a business owner. It is wise for business owners to protect themselves from such complications. The latest case ruling – Dynamex Operations West, Inc. v. Superior Court of Los Angeles – the California Employment Development Department (EDD) – shows that California is getting stricter with conducting these investigations, which are essentially worker re-classification audits.

One way to protect yourself and your business from harm resulting from an EDD audit is by ensuring that all classification of employees is done correctly during payroll taxes. In California, the payroll taxes are much higher compared to those of other states. Collection of these taxes falls to the California Employment Development Department (EDD), which takes charge of ensuring that payroll tax audits of companies and businesses are being carried out. Allison Soares, an experienced and skilled Orange County, San Francisco, or San Diego EDD audit attorney, helps businesses succeed by guiding them on how to correctly assess taxes and plan accordingly. Her knowledge and practice of corporate and business law give her a competitive edge in the world of California taxes. Whether you own a business in Orange County, San Francisco, San Diego, or anywhere else in California, call Allison Soares for advice on how to best organize your business and how to assess which taxes you have to pay.

Allison Soares practices the following legal areas:

- EDD audits, appeals, and collections

- IRS tax matters and audits

- CDTFA audits

- FTB audits

- Business law (business advisory services)

- Business formation

- Corporate law

- and other business tax matters in California

How Taxes Are Affected by the Classification of Employees

The classification of employees by employers is the primary objective of the EDD auditors during a payroll tax audit. It is the result of this classification that helps in assessing the amount of payroll taxes a business owner pays, and if the classification from the owner is erroneous leading to a low pay of EDD payroll tax. If it’s determined the amount is low and that the classification is wrong, the auditor will indicate you owe the EDD more money. It’s also important to keep in mind that this EDD assessment is likely to be useful for the IRS. In most cases, the results of an EDD audit is utilized by the IRS for federal assessment of taxes, interest, and penalties.

One of the biggest mistakes business owners make, which may end up limiting business profits and flow, is the misclassification of a single employee, whether intentional or not. Most of the time, this error is unintentional. But as a result of the misunderstanding, the EDD auditors will levy high penalties and fees.

Essential Rules to Help Reduce the Complexity of Classifying Employees in California

There are some essential rules to help reduce the complexity and correctly classify an individual as an employee or an independent contractor. You need to know these rules to avoid misclassifications. It is the responsibility of the business owner to pay payroll taxes for an employee while still paying the employer portion of the payroll taxes. The employer is not responsible for the independent contractor payroll taxes, as this is the sole responsibility of the individual. How this is determined is based on who is in charge and the level of control.

An employee does not make choices when it comes to the length of work to be done, control of workflow, location of work, and time of work. Also, an employee is under the supervision and control of the business when it comes to the employee’s productivity, schedule, and work. When it comes to classifying a worker as an employee, there is typically control by the business owner on the employee’s affairs.

Employer control is absent when it comes to the work of an independent contractor. For independent contractors, control of workflow, time of work, and place of work is their sole responsibility. An example of an independent contractor is a gardener or cleaner. They work according to their time and also for numerous people, with the provision of work tools handled by them.

Seek Professional Advice from a skilled EDD Audit Attorney in California

During a classification audit, the EDD and IRS use a number of factors to help them determine if a worker is an employee and an independent contractor. However, it’s important to note that none of those factors are pre-requisites when it comes to classification. Classification of workers is based on factual determination and on a case-by-case process. This method leaves business owners prone to mistakes that lead to taxes, penalties, and interest. Save your business money, trouble, and stress by getting informed from the start. Call Allison Soares today and ask for her professional advice. As an experienced Orange County, San Francisco, and San Diego EDD audit attorney who also practices corporate and business law, she will be able to guide you on the best path for you and your business, so that all you have to worry about is how to flourish your business. Call today!

Why am I being audited?

One event for triggers an EDD audit is when a former worker files for unemployment. The application for unemployment, even when filed by an independent contractor, is an indication that the contractor was formerly an employee because unemployment is only open to employees. Unfortunately, another agency can perform a “raid” on a work site (particularly with contractors). They will send a multitude of agencies, including the Department of Labor, EDD and Workers Compensation, to a work site to interview workers and determine if they are being treated as employees. The will perform on-site interviews with the workers, asking the type of work they perform, how long they have been performing it, how they are paid, when they are paid, etc.

Another reason an EDD audit may occur is due to the late payment of payroll taxes, cash salary payment, reports by an unhappy worker, or late payment of wages. If you require assistance, seek help from a dedicated Orange County EDD audit lawyer at Allison Soares, Attorney at Law today.

How does an EDD audit start?

The first indication of an EDD audit is when you receive an Inquiry Regarding Records notice from the EDD. This means your business has been selected for an audit. This audit specifically targets the payroll taxes. Unlike the IRS notice of audit, the EDD audit notice can be inconspicuous and some businesses do not even know they are under audit.

Example of an Inquiry Regarding Records notice:

The contents of the notifications include a list of the necessary files needed for the audit and the Preaudit Questionnaire. The necessary documents may include bank and financial statements from the business for a specific time and period. It may also include copies of checks, check registers, ledgers, journals, pay records, 1099s, W-2s, and EDD’s Quarterly Contribution Return and Report of Wages (Forms DE-9 and DE-9C). The questions are written to root out the payroll practices of business owners, and serve as bait for the EDD audit in knowing how to approach the main audit carried out later.

Example of a Pre-audit Questionnaire:

How should I handle the audit?

While an EDD audit is a stressful process, it’s always best to take a friendly approach with your auditor. You also want to make sure the information requested by the EDD auditor is provided in order to reduce the penalties that may be incurred. That being said, you want to avoid sharing more information than necessary as you may wind up in a situation where you provided too much information that may not work to your advantage.

Normally the auditor examines payroll tax records for a specific timeframe, usually a three-year period. When it comes to worker classification, it is an auditor’s duty to use different factors available to determine the right classification of a worker, whether it’s as an employee or an independent contractor. The IRS and EDD have different methods and factors they consider during classification and this gives rise to the different classifications of the IRS and EDD when it comes to a worker or an employee.

Is it almost over?

At the conclusion of an audit, you may receive results that are not favorable to you and you may receive a bill from the EDD. The tax bill may show an incorrect payment of taxes due to low payment made in comparison with the amount charged to the business by the EDD. In rare cases, the results may reflect no change seen in the audit in comparison with the last audit.

The penalties obtained as a result of the underpayment of payroll taxes by a business is added to the interest rate and also the original payment of the taxes. These penalties and interest are charged by the EDD. A 10% increase in penalty will also be added if the deadline for the original payment has passed, typically around 30 days. It is best to avoid these penalties and interests by avoiding underpayment. However, a taxpayer has the option of appealing an EDD assessment if not satisfied by the assessment, or if an error during the determination process is noticed by the taxpayer. It is usually double jeopardy for a taxpayer if the underpayment is determined by the EDD because the IRS will use these results to determine federal taxes, interest, and penalties.

Tips For a Successful EDD Audit

- Respond immediately to an EDD Inquiry Regarding Records and set up a meeting with them. Seek professional help from an Orange County EDD audit attorney or tax attorney.

- Prepare thoroughly before going into an audit is vital. Be sure to have all the appropriate or required documents. Also, remember to go with secondary copies, not originals.

- Organization of your documents will help in a smooth audit

- Do not underestimate the EDD, or attempt to hide anything as that may be used against you in the process

Always consult an experienced Orange County EDD audit attorney to help you avoid liabilities and penalties incurred during the California EDD audit. For a thorough guide and assistance, contact an experienced Orange County, San Francisco, or San Diego EDD audit lawyer. Their experience in cases similar to yours, along with their knowledge of California tax law, will provide you with the protection you deserve.