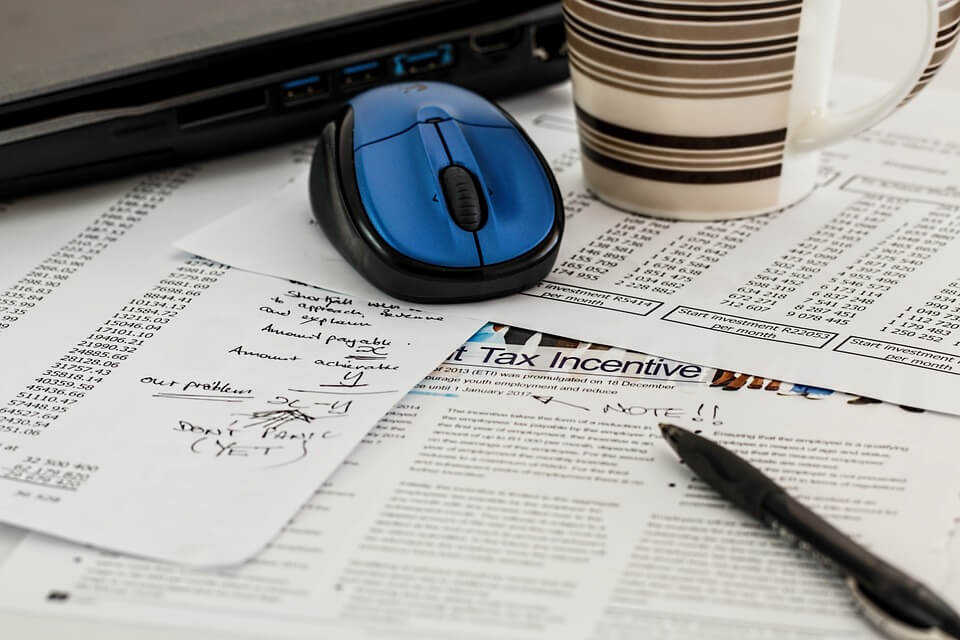

Are You Eligible for the California In-State Voluntary Disclosure Program? California has three different taxing agencies: California Department of Tax and Fee Administration (CDTFA), the Employment Development Department (EDD) and the Franchise Tax Board (FTB). If you are a San Francisco business owner in California, you must understand each agency and what taxes you need...

Are You Eligible for the California In-State Voluntary Disclosure Program?

Categories: California Tax Law